Ultimate FREE Printable Monthly Expense Tracker [PDF + How-To Video]

This post may contain affiliate links for your convenience. That means that if you make a purchase, I will receive a small commission at no extra cost to you. Read more here.

If finding out that the average American household carries nearly $40,000 in debt doesn’t shock you, how about this statistic: less than 60% of people could scrape together $1,000 in the case of a financial emergency? The truth is many people have no clue how much they are really spending every month — a Starbucks coffee here, a quick Chipotle burrito there, and BAM! there goes the ‘ole budget plan.

But don’t worry, you’ll do better next month — or will you?

This month, you can tell yourself YOU WILL be better about budgeting! Because now you have this free printable monthly expense tracker to help you stay on budget!

The Free Printable Monthly Expense Tracker that will revolutionize your budget

You know how you put off cleaning for a few days, then maybe a few weeks, and then suddenly you look around and your house looks like a bad episode of Hoarders?

Turns out the same thing can happen to your budget!

Knowing where your money is going is one of the first key steps to taking control of your finances — a keen awareness of where your dollars and cents are being funneled each month will help you better manage your money in the future!

After all, how do you know how could you possibly know how much money you are saving if you don’t know how much you are spending?

That’s why the first step in creating a budget should be to track monthly expenses.

Now, you could simply pick up a notebook and start jotting your spending — but why do that when you could just download an awesome free monthly expense tracker PDF printable?

This monthly spending tracker will help you:

- Customize expense categories tailored to your specific needs

- Track spending across two primary budget expense categories (fixed & variable)

- Easily write down day-to-day expenses for 30-days

- Notice patterns of overspending so you can correct them

- Plan your monthly budget for the future

- See how much money you save each month

- Help you hit all your money goals and CRUSH debt!

UPDATE: This budgeting printable helped us pay off $250,000 of debt and buy our dream home in Europe – watch our new home tour! (Don’t forget to subscribe!)

Fixed versus variable expenses

I know you’re excited to get started, but before we dive headfirst into tracking your spending, let’s discuss the difference between fixed and variable expenses.

What are fixed budget expenses?

Fixed expenses are expenses that are paid once per month at roughly the same cost; examples of fixed expenses would be mortgage, rent, insurance, property taxes, phone bills, etc

In some instances, fixed costs may be paid in one or two lump payments each year — this is typically the case for bills such as property taxes (one lump sum per year) or car insurance (paid every six months or so).

To calculate the monthly cost for those fixed expenses you will first take the amount that you typically pay (let’s say, $600 of car insurance) and divide the cost by the number of months it covers (a six-month time period).

Thus: $600/6 months = $100 per month.

Therefore, for this example, you would write “$100” in the fixed cost column for car insurance.

You will only enter ONE number for each of the fixed cost categories.

Note: while expenses such as gas and electric may fluctuate by a small margin from one month to the next, they are still considered relatively fixed as they are paid once per month.

Try and write down an average payment for these utility categories; once you really start paying attention and recording your spending, you can average the data out over time.

🔥 HOT TIP! Find out what the “big three” expenses are + how to reduce them (and save tons of money!)

What are variable expenses?

Variable expenses are those expenses that you incur several times per month, and at varying costs; examples of variable expenses would be buying groceries, eating out, going to the movies, shopping for new shoes, hosting a wine-tasting party, etc.

You will enter multiple expenses in each column for “variable expenses”.

You will notice that both the fixed and the variable expense categories on this free printable monthly expense tracker have a few extra empty spaces; those spaces were purposely left blank so that you could add additional budget categories tailored to your specific needs.

For example, if you have children you might choose to add a Kids category; if you are in college and you like to go out and party, you might add a category for Alcohol.

Add whatever makes sense for you and your budget!

Budgeting for fixed and variable expenses

When people budget they tend to forget about fixed expenses because they don’t notice the daily “pinch” of cutting back on those costs as much as they would, say, skipping lunch for lack of money.

However, fixed expenses can still be a great place to cut costs, so don’t rule them out of your budget cuts entirely!

After all, if you are able to reduce or eliminate a fixed expense you can benefit from huge yearly savings since you will eliminate that cost across a 12-month period.

That is one of the reasons the tiny house movement is so popular; by downsizing drastically, they save money across multiple fixed categories at a time (mortgage, insurance, utilities, etc) in one fell swoop!

When you track all your expenses with this budget tracker, you will be able to really take notice of all your expenses at a glance, which makes it much easier to see patterns of overspending and help you better plan how to budget and save money later.

How to track your spending with this monthly expense tracker

There are three rules you need to remember when using this expense tracker:

- Be consistent

- Be honest

- Write it down

Consistency is key when it comes to budgeting.

To reap big rewards and huge savings takes patience and attention to detail. That’s why you need to be consistent and get into the habit of tracking all your expenses.

You need to be totally honest and diligent about tracking your spending, and that means writing everything down, even if it’s only $1.50 for city parking, a $1 bus fare, or a quick $2.00 coffee.

If you are putting it on a credit card, that counts too!

If you feel self-conscious about writing down your expenses at work on a budget tracker, just save all of your receipts and bring them home. Then, at the end of the day, you can enter each expense into its appropriate category.

You may fill up some columns faster than others, and that’s okay — feel free to print off this tracker more than once!

If you have a receipt that includes more than one category (for example, you went to the grocery store but also bought diapers), try to divide those between their respective categories.

So I would take the price of the diapers, add that to the BABY column, and put the remaining cost minus the cost of diapers under GROCERY.

You don’t need to get too picky and try to separate the tax for each, just subtract the lesser price from the total.

How to calculate budget expenses and savings

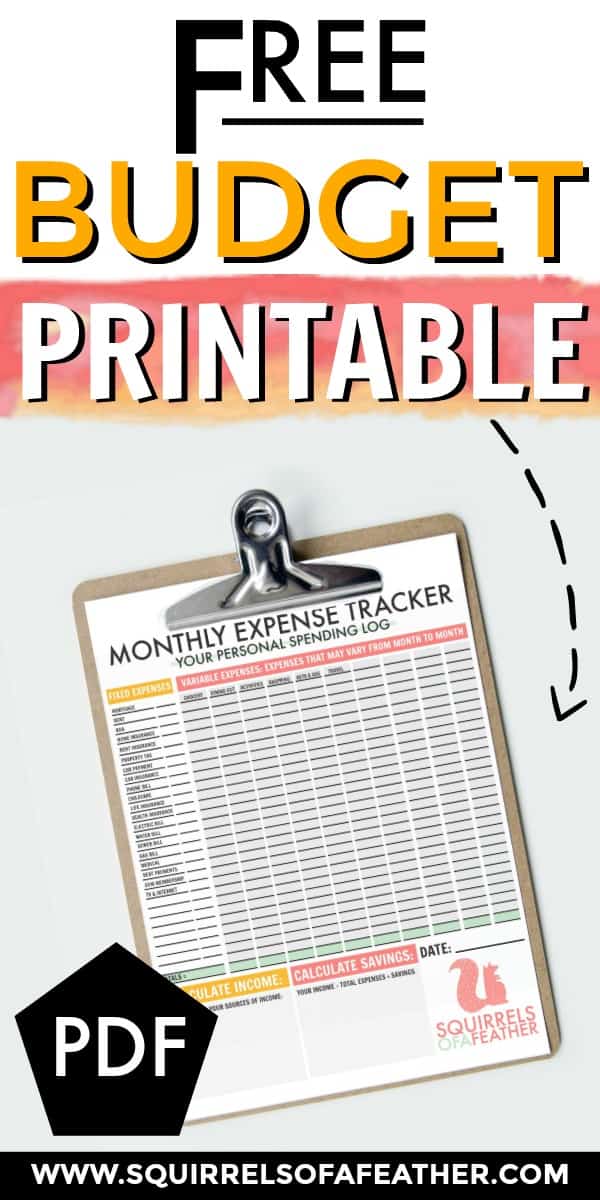

At the end of your 30-day budget tracking, you are going to sit down with a calculator, your Monthly Expense Tracker printable, and you are going to tally up your spending for each of the budget categories.

Calculating fixed expenses:

Start by adding all of the fixed expenses together, from top to bottom, and enter in the space for “Totals” at the bottom (in green).

Calculate variable expenses:

Add together all of the costs in each column for your variable expenses — you will have a total spending result for groceries, dining out, shopping, etc (enter in the green space at the bottom of each variable expense column).

After you get all of the expenses added up for each of the variable expense categories, you will then add them all together to get a total for all your variable expenses – place that number on the far right side, in green.

Calculating the total monthly expenses:

Once you have the totals for fixed and variable expenses, simply add those two numbers together.

That number is the total cost for everything you have spent in the past 30 days!

Calculate your monthly savings:

Here is how to calculate how much money you are saving each month now that you have tracked your spending for 30 days.

- Figure out your AFTER-TAX income (add your paychecks together if you get more than one per month; most people are paid bi-weekly)

- Use this formula to calculate your savings: total monthly after-tax income – total monthly expenses = total savings per month

- Enter the total savings at the bottom of your tracker, in the gray area; note any categories you overspend on and need to work on in the gray square to the right

✨ NEW!✨ GRAB A BONUS BUDGET PLANNER AS WELL!

New 2021 update: a complete budget planner worksheet was added as a bonus!

Watch the complete YouTube video on how to track your monthly expenses!

Need more help with tracking your spending?

Check out my complete YouTube video guide on how to track your spending every month so you can save, save, SAVE!

What to do after tracking your spending (aka, it’s budgeting time, baby)

Congratulate yourself; you have just taken your first step towards taking control of your budget!

However, while this is an accurate record of your monthly spending, you SHOULD NOT consider this your budget.

It is very likely that you have overspent in many areas, so the next step is figuring out how to create a budget that works for you and your family.

Believe in the power of a good budget!

Being financially savvy has helped us pay for an all-cash dream wedding, find sneaky ways to increase our income, and save 50-70% of our income year after year!

YOUR NEXT STEP: Find out how to create the perfect budget for you and your family!

Pin this post to read again!

It is not so common to find such detailed how-to-budget posts. Thank you so much!