How to Do a No-Spend Challenge to Save Money [PDF]

This post may contain affiliate links for your convenience. That means that if you make a purchase, I will receive a small commission at no extra cost to you. Read more here.

A no-spend challenge is a popular way to save money. They can be used as a starting point for your personal financial goals or as an exercise in living with less.

This blog post will teach you the basics of how to do a no-spend challenge the right way, no matter if you’re trying to go a few days without spending money or shooting for a no-buy year!

No matter your income, budget, or history with money, be confident and tell yourself you can do this!

What is a no-spend challenge?

A no-spend challenge is a popular money challenge in which you quit spending money for a set period of time.

The duration and rules of no-spend challenges may vary, but the general idea is to live without buying anything other than essentials during that timeframe.

No-spend challenges are beneficial for all sorts of budgets and lifestyles, and the rules and goals should target problem areas or expenses that you struggle to control.

An 18-year-old college student living in a dorm with three roommates might want to save money to pay off their debt and focus on cutting spending on clothes and eating out.

A thirty-something stay-at-home mom of two might want to save up for a family vacation and reduce how much they spend on toys and home decor.

No-spend challenges are also called:

- No shopping challenges

- No-buy challenges

- Spending freezes

Why do a no-spend challenge?

There are plenty of good reasons to participate in a no-spend or no-buy challenge!

Think of it as a financial detox; it’s not a permanent solution that can fix all your money troubles, but it’s an excellent way to shake up bad money habits like emotional spending or impulse buying.

If you’ve made it a personal goal to stop spending money on stuff you don’t need, money challenges like this make saving money easier and more fun.

They challenge you to flex your “don’t spend money” muscles, which in turn can encourage growth and progress when it comes to budgeting and frugal living even when you’re not participating in them!

Here are a few benefits of no-spend challenges.

READ MORE: 10 Simple Minimalist Budget Tips That ACTUALLY Work!

1. They help save more money

The obvious benefit of no-spend challenges is that they help you save more money.

Doi, right?

According to the U.S. Bureau of Labor Statistics (BLS) Consumer Expenditure Survey for 2020, the average American household spends a whopping $5,102 every month.

It might be hard to cut significant fixed expenses like housing costs (an average of $1,674) or healthcare (an average of $414). Still, there are plenty of opportunities to cut spending in flexible spending categories like food and shopping.

Here are a few of the most common areas that people target in a no-spend challenge and the monthly spending averages for each.

- Transportation – $813

- Groceries – $372

- Eating out – $288

- Entertainment – $269

- Apparel or services – $156

- Personal care – $64

Let’s say that you go for the 30-day no-spend challenge, and you decide to stop spending money on eating out, entertainment, buying new clothes, and personal care like makeup and hair.

If you don’t spend money on any of those things for one month, that will give an average person a savings of $719 for those 30 days!

If you challenged yourself to save that much for 52 weeks, or one full year, you’d save $8,628 by the end.

READ MORE: How to Do a 52-Week Money Saving Challenge RIGHT NOW!

2. You can save a LOT of money at once

There isn’t a much better way to save a lot of money all at once than doing a spending freeze like this.

Just those tiny cuts above would allow you to save $719 in one month – but what if you wanted to go even farther?

What if you tried carpooling, riding your bicycle, or walking instead of driving or taking public transportation?

Or if you’re going for a more extended challenge, like a no-buy year, you could swap re-occurring monthly expenses like a gym membership for working out at home.

You could easily save $1,000 a month with just these slight modifications! Some people report saving $100 a day when they add in ways to make extra money.

3. Money challenges fight bad spending habits

Almost everyone has their weaknesses and bad spending habits, but not many people are willing to talk about them!

While it’s not a long-term solution to fix financial woes, money challenges can help you break bad money habits by forcing you to confront them head-on.

For example, if you’re someone who has a hard time saying no to buying things that are on sale, then a no-buy month may be just what you need.

If you can’t walk past the dollar aisle at Target without grabbing $20 worth of crap you didn’t want or need, only to regret it later, then consider this is an excuse to do better.

Who knows, you might even discover that you enjoy not spending money and dive headfirst into minimalist living!

4. To help you pay off debt

A no-spend month can help you get out of debt faster.

The average American has around $90,460 in debt, including credit card debt, personal loan debt, mortgages, consumer debt, and student loan debt. That’s a lot of debt!

Living with debt can be stressful, especially if you have large or very high-interest debts hanging over your head. If you save up a big lump sum all at once, it’s a great idea to knock off some of that debt!

RELATED POST: Minimalism in a Crisis – What to Do?

5. Encourages financial literacy and teamwork

There’s a popular money saying that goes, the family that saves together stays together.

If you live with a partner, are married, or have children, it’s essential to work together as a team when it comes to saving money. After all, a chain is only as strong as its weakest link, and if one person is frivolous with their money, they can drag the rest down with them.

No one said this is easy, however!

Money is such a taboo topic that parents are scared to talk to their kids about it, perpetuating bad money habits even further.

One study found that:

“69% of parents have some reluctance to discuss money matters. And 61% of parents only discuss money with their kids when their kids ask about it.”

No matter the size of your home or your family, a no-spend challenge is a great bonding exercise that can bring you all closer together.

What type of no-send challenge should you do?

There are so many options for spending freezes, from duration to what to cut.

Again, the rules can vary from challenge to challenge and person to person, so make sure you’re clear on the dates and rules before you start.

Here are a few popular no-spend challenge ideas:

- No Spend Weekend – suitable for no-spend beginners and people who want to save up a small amount of money.

- 7-Day No Spend Challenge – good for spending freeze beginners who want to save a small to moderate amount of money.

- 30-Day No Spend Challenge – good for medium to advanced no-spend challenge participants who want to save a lot of money fast. If you’ve never done a no-spend challenge before, you might want to try a no-spend weekend or 7-day no-spend challenge before you try this.

- No-Spend January – this 30-day no-spend challenge is suitable for those who want to save more money in the New Year and start the year off right.

- No-Spend November – another 30-day spending freeze, which many people participate in to save up more money for their holiday or Christmas budget.

- One Year No Spend Challenge – a no-spend year is for more advanced money-savers. If you want to stop spending money for one year, I suggest attempting smaller spending freezes before this challenge. (If you’re gung-ho about this, check out a book called The Year of Less by Cait Flanders on Amazon for inspiration.)

How to do a no-spend challenge

Okay, are you pumped up to get started saving money? Here’s how to do a no-spend challenge.

1. Pick your no-spend goals

Before you start your challenge, get clear on your “why.”

Your why is the reason why you want to do a no-spend challenge in the first place. Maybe your no-spend goal is to save up for something special like a vacation, an engagement ring, or to put towards a downpayment on a house.

Having a clear goal for yourself and your money can help keep you focused when you feel tempted to spend money or break your spending freeze rules.

It’s like a bright and shining North Star guiding you towards a better financial future!

2. Choose a start date

I mean, no one likes to go out and run forever, right?

No matter if you’re participating in a race or training for a marathon, you either set a timer or have a distance goal that you are trying to reach before your feet even hit the pavement.

Therefore, it’s much easier to work towards a goal when you have a clear start and finish date.

Choose a start date that works well with your schedule and that everyone can agree on. It might not be a good idea to plan a spending freeze right before a birthday or planned trip.

Having a start date also helps you plan ahead and be prepared for the challenge. For example, if you decide not to spend money on transportation, you might need to stock up on food before the challenge – no matter what, people gotta eat!

Hey, you might even go so far as to pre-plan your meals to be as cheap and budget-friendly as possible, so you save even more money.

3. Set your no-spend rules

After you’ve nailed down the dates for your no-spend challenge, the next step is to set your rules. Some people aim to cut spending on non-essential items, and others want to stop spending money altogether.

What you cut and allow is up to you, but here are some ideas about stopping spending money.

What to stop spending money on

- Eating out

- Takeaway coffee, teas, and drinks

- New clothes or shoes

- Movies or theater

- Haircut, hair coloring, and nailcare

- Makeup and other non-essential beauty products

- Toys, gifts, and parties

- Home decor

- Books or magazines

- Etc.

What is allowed?

- Groceries

- Bills and utilities

- Gas or transportation (if no other options)

- Phone and internet

- Essential items for the home (if something should break)

- Emergency services

4. Halt your spending

The time has come!

Once you start your spending freeze, it’s your job to say no to any non-essential items.

It’s important to be strict with yourself and commit to this no-spend challenge if you want to see results. So put your willpower into overdrive and stay strong.

You can do it!

If you find it hard to stop spending money if you go out, you might just want to stay home. After all, there are plenty of ways to entertain yourself at home without needing to spend money!

Put as many barriers to spending money into place as you need because the harder you make it to spend money means the less likely you will be to do it!

5. Track your no-buy progress

It’s critical to track your spending and experiences with this challenge. That way, at the end of the challenge, you can look back and see what you did well, what went wrong and analyze your successes and failures.

If you leave it up to your memory, you’re more likely to forget, so make sure you write things down, cross off the days, or keep receipts.

Here are a few ideas to track your spending freeze:

- jot down notes on your phone

- keep a journal

- maintain a Google doc or Excel spreadsheet

- use a calendar you can write on

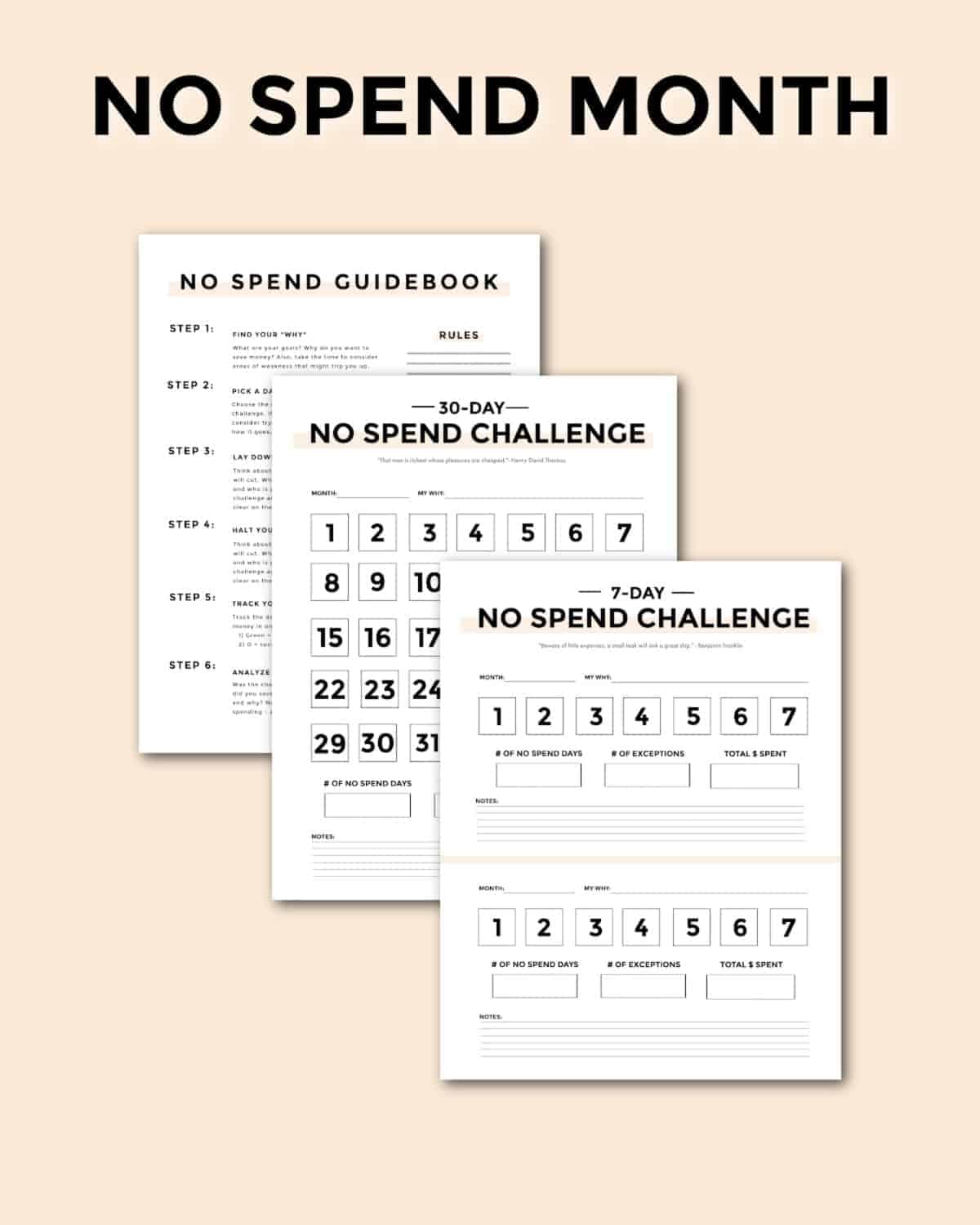

- print off a no-spend challenge printable like this one

6. Analyze your experience

Listen, even if you break the no-spend challenge rules, not much is going to happen.

It’s not like the spending freeze police are going to knock down your door and shout, “HOW DARE YOU SPEND MONEY!!”

But keep your money goals in mind because if you break the rules, the only person that loses is you!

If you break the no-spend challenge rules once, it’s okay! Remember, no one is perfect, and it’s tough to do a spending freeze when you’re starting to save.

However, that doesn’t mean you should just quit!

Nope, just like Batman’s dad says, you’ve got to pick yourself right back up and get on that bicycle. Falling down isn’t a loss; falling down and not picking yourself back up is.

Our greatest glory is not in never falling, but in rising every time we fall.

— Confucius.

How to learn from this challenge

At the end of the challenge, take some time to reflect on how the no-spend challenge went for you.

- What were your successes?

- What were your struggles?

- How could you have done things better?

- What category was the most difficult?

- What situations caused you to break the rules?

- What was your favorite part of this challenge?

- What was your favorite part about this challenge?

The goal is not to be perfect but to learn and grow from our experiences – even those that didn’t go as planned.

RELATED POST: 25+ Free Printables to Declutter, Organize, Clean, Budget, & Plan

Final thoughts on no-spend challenges

A no-spend challenge can be a great way to jumpstart your savings, but it’s not the only tool in your arsenal.

There are other ways to save money, and you should pick, choose, and combine the money-saving ideas that work best for you!

Want to save even more money?

Check out any of these fantastic resources below to spend less, save more, and even make extra money fast!