20 Bad Money Habits to Break (Before It’s Too Late!)

This post may contain affiliate links for your convenience. That means that if you make a purchase, I will receive a small commission at no extra cost to you. Read more here.

Like it or not, money is one of life’s essentials; it’s also one of the most challenging things to manage. It’s not uncommon for people to find themselves struggling financially because of bad money habits.

If you’re looking to break free from the cycle of debt, poverty, or financial instability, it’s important to identify and change these bad habits.

This blog post will discuss poor money habits you need to break right now, so you can stop wasting money and start saving! You might also enjoy this post on the seven steps to becoming a financial minimalist if you want to spend less and save more.

20 Bad Money Habits to Break ASAP

These bad financial habits include frugal habits that don’t pay off in the long-run and money habits that keep you broke.

Stop saying “I’m bad with money” and take a stance to change your financial future by breaking these habits that keep you poor.

You’ll be glad you did once you begin reaping the benefits of frugal living.

Stick around until the end of this blog post for two helpful video guides discussing the top bad money habits from myself and my financial minimalist buddy, Gabe Bult.

1. Buying more to save more

Buyer beware – those “Buy Two, Get the Third Free” and “Get $20 Off When You Spend $100” signs are a trap!

Anytime you see sales or discounts that encourage you to spend more or buy extra to save money, it’s almost always the wrong decision. In most cases, you end up spending the extra money to buy items you didn’t need or want in the first place.

2. Bad thrift shopping habits

Thrift shopping can save you money, but it’s also fun! So much fun that you might end up spending too much and buying crap you don’t need just because you feel like you are getting a bargain.

Also, certain thrift shops and secondhand stores take advantage of people who want to save money but aren’t too savvy about how much things ought to cost. These shady stores use predatory pricing structures to hike up prices way beyond what would be reasonable for secondhand merchandise.

I once found a set of sandbox toys for children with the tags still on for DOUBLE the original price! I pointed this out to the manager and got a 75% discount, but only because I noticed the issue.

The #1 best thing you can do to avoid being cheated is to have your phone handy to check the pricing of similar items online. The free eBay app is a great place to start, and you can check the “sold price” for similar items.

READ MORE: 53 Thrift Shopping Tips to Score BIG Deals (and Save Money)

3. Spending a lot of time or effort to save a little

Don’t be pennywise and pound foolish. If you realize that you are spending a lot of time or effort to save a few bucks, you might need to ask yourself if that time would be better spent elsewhere.

This includes things like driving really far to save on furniture or shopping at five grocery stores to save a few dollars.

All the gas and time you burn up driving so far and shopping around might have been better spent shopping strategically at a single store or finding affordable furniture much closer. When you know how much your time is worth you are better equipped to make choices to help you spend it wisely to save smarter.

4. Hoarding

Repurposing and upcycling old stuff to put it to good use is not only thrifty but also helps reduce waste going into landfills. It’s both smart and eco-friendly!

On the other hand, holding on to too much useless junk “just in case” or because you are too sentimental to let it go can harm you in more ways than one.

As the stuff piles up in your home, it also weighs upon your mind. This, in turn, can end up causing side effects that hurt your mental or physical health (read more about that in this post on the benefits of minimalism.)

If you’re paying money to store stuff you haven’t seen in years, hanging onto clothes from when you weighed 20 pounds less, or keeping every scrap of paper that comes your way, it’s time to let it go.

5. Freebie Addiction

I admit it – I am a recovering freebie addict!

I used to accept all the stuff that my friends would declutter from their homes and closets just because it was free. Also, I would find random stuff lying around on the street and bring it home with me.

I thought I was being thrifty and saving money bringing home these bags of discarded clothes, old toys, and worn-out furniture items I found on garbage day.

But 99% of the time, it wasn’t worth it, and I was bringing home a ton of junk that took up extra space in my house – as well as time, money, and energy – storing and maintaining it!

But not only that; if you aren’t careful, that free stuff might end up costing you thousands of dollars!

I know multiple people who have picked up free furniture, only to find out there was a bedbug infestation. After that, they had to spend tons of money on expensive exterminator services and replacing furniture.

So accept freebies with the utmost caution!

6. Being a pushover

It’s okay to be a loyal person, as long as your loyalty is being appreciated or rewarded!

However, if you’re working yourself to the bone for a boss or company that doesn’t appreciate or underpays you, it might be time to hunt for a new job.

Likewise, if you have friends or family members who take steal from you, cheat you, or otherwise take advantage of you financially, you may need to set boundaries or reduce contact.

You can read more about how to recognize and deal with toxic people in the blog post below, because, unfortunately, this sort of financial manipulation is all too common.

READ MORE: 30 Signs of a Toxic Person That Scream “AVOID ME!”

7. Going cheap on big-ticket items

There are some areas in life where you get what you pay for. Certain things are worth splurging for or paying a little more, such as mattresses, shoes, cars, and other big-ticket items.

For example, a cheap mattress may not provide enough support and lead to back pain, which could require expensive chiropractic treatments or massages down the road.

You may think you’re saving money by going for the cheapest option, but you’ll end up spending more in the long run in many cases.

8. DIY-ing the wrong things

Some things are best left to the professionals. For example, if you’re not experienced in electrical work, don’t try to fix your own wiring during a renovation – leave it to a licensed electrician.

The same goes for complex home repairs.

Unless you’re confident you can do it right the first time, you might cost yourself more money in the long run if you do a shoddy job and botch a significant repair.

9. Skimping on your health

Skimping is not the way to go when it comes to your health. Trying to save money by cutting corners on things like dental and vision care, or going without health insurance, is a dangerous game of rolling the dice.

Also, eating cheap foods high in preservatives and salt can result in long-term health effects like diabetes or hypertension.

There are plenty of cheap meals that are also healthy for you, and you just need to know where to look for them. Pinterest is a good place to start!

10. Keeping up with the Joneses

Make sure you are budgeting and spending your money in ways that satisfy you, and stop worrying about what other people might think or do themselves.

Just because your friends or neighbors have the latest gadgets, go on fancy vacations, or wear designer clothes doesn’t mean that you need to as well. What works for them financially might not work for you, and vice versa.

Also, keep in mind that you might not be able to tell if they are struggling financially behind the scenes. On the outside, they might dress well, live in a big house, and drive a nice car, but behind the scenes, their bank accounts are overdrawn and they are drowning in debt!

There is no point keeping up with the Jonses if they’re going someplace you don’t want to go.

– Michael Hyatt

11. Ignoring your debt

It can be scary to confront your debt and think about all the money you need to save to get out of that hole.

But the sooner you start, the better off you’ll be. The most important thing is to have a plan to tackle your debt – and stick to it!

Make sure the whole family is on board, too, because if one person is saving while the other is spending, that’s a recipe for disaster.

12. Late fees

Late fees can add up, and they’re avoidable if you’re just more mindful about when your bills are due.

It’s even more upsetting when you realize that the pennies you save on their laughably low interest rates can be wiped out with one $35 late fee if you don’t pay on time!

Either set up a reminder on your phone or calendar so you know when they’re coming up or enable automatic payments so that the money is withdrawn from your account on time.

Just make sure you:

- have the money in your account to cover your bills

- check in once in a while to make sure all is well

13. Saving what’s left after spending

Most people are saving money backward! Instead of saving what’s left after spending, they should be spending what’s left after saving.

Make saving the number one priority, and then set your budget based on what’s left afterward.

14. Lifestyle creep

Lifestyle creep occurs when your lifestyle gradually becomes more expensive as you earn more money.

It’s easy to fall into the trap of thinking “I worked hard to earn this raise/bonus/promotion, so I can afford to spend more.”

But rather than letting your lifestyle creep up along with your income, a better money habit would be to keep your spending in check and use that extra money to pay off debt or build your savings for bigger financial goals, like a downpayment for a home.

15. No budget

Does the word “budget” send a shiver down your spine?

If so, don’t be intimidated. A budget is simply a tool that can help you better understand your buying habits and make more informed choices about where to spend your money.

A budget allows you to track household expenses, stay on top of bills and payments, make a solid plan to pay off debt, etc. Over time, keeping a budget can also help you pinpoint areas of weakness in your financial habits and brainstorm ideas to strengthen them.

If you want more help with creating a budget, here are a few blog posts to get you started.

- 10 Minimalist Budget Tips to ACTUALLY Save Money

- The Complete Guide on How to Budget Like a Pro

- Download This FREE Budget Planner Right Now [PDF]

16. No emergency fund

One of the worst money habits is not having an emergency fund.

Emergencies happen, whether it’s a car repair, an unexpected medical bill, or a job loss. If you don’t have savings to cover these expenses, they can undo all of your progress and send you into debt!

Most experts recommend having three to six months of savings in an emergency fund that you can access quickly and easily.

We like to keep ours in a high-yield savings account like CIT Bank so that even while the money is sitting there, it’s still collecting more interest than the average savings bank.

“Money doesn’t make you immune to the little speed bumps in life, but it can easily turn an emergency into an inconvenience.”

– Dave Ramsey.

17. Too much budgeting

Budgeting is powerful, but too much of a good thing can also be harmful!

When you are too restrictive with your spending, it can lead to feelings of deprivation and make it harder to stick to your budget long-term.

It’s like a bad diet that you’re bound to break!

Instead of being overly restrictive, try giving yourself some wiggle room in your budget for fun money that you can use however you want. This will help you stay on track without making you feel miserable.

You don’t have to spend a lot of money to treat yourself; even something small like going for ice cream with the family or relaxing in the bath with a glass of wine and a good book can do it!

This will help you avoid budgeting burnout and stay in the game to be a money-saver for life. If you practice intentional shopping habits, then there’s no reason to feel guilty about spending money.

18. Putting your money into collectibles

I’m sorry to say that this bad money habit lost my family a lot of money. 🙁

It was antiques and coin collections for my dad, but he and my grandmother also poured a lot of money into Beanie Babies, Barbie dolls, Swarovski crystals, and all sorts of collectibles.

I grew up hearing them rave about how these things would pay for my college one day. Spoiler: they didn’t, and I had a mess of a time decluttering all that emotional clutter after 30 years of hoarding.

Collectibles can be lucrative, but you need to know what you are doing so you don’t get cheated or lose money. It’s almost always better to invest in the stock market rather than putting your money into things like Cabbage Patch Dolls and Longaberger baskets.

Also, it’s totally okay to have collectibles like the ones I mentioned about just because you like them! Just don’t put your proverbial financial eggs all into this basket.

19. Thinking saving is enough

This brings us to the next money habit keeping you broke, which is not growing your money!

At the time of this writing, inflation is at 8.3%, which is the highest in 40 years. What does this mean for you?

It means that if your money is sitting in a savings account, it’s actually losing value because inflation is eating up a big chunk of it, so your dollars and cents are worth less at the end of the year. You need to be investing your money so it can grow and keep up with inflation.

One thing frugal people can learn from the habits of wealthy people is to make money work for them. Wealth creation is done by investing your money and multiplying it while you go about your daily life and allowing it to grow without any additional effort.

20. Limiting money beliefs

Growing up poor or experiencing financial hardship can create limiting beliefs around money that are hard to shake off.

If you grew up in a family that never had enough or were told that money is the root of all evil, it could be tough to change your mindset and see money as a positive force in your life.

Recognize that money is a tool, neither inherently good nor bad.

It’s okay to want to be wealthy, and it’s okay to enjoy having money. You deserve to have financial abundance and success in your life and that doesn’t make you a selfish person.

When you find yourself slipping into negative thoughts about money, turn your can’ts into cans. Stay positive, and you can accomplish a lot!

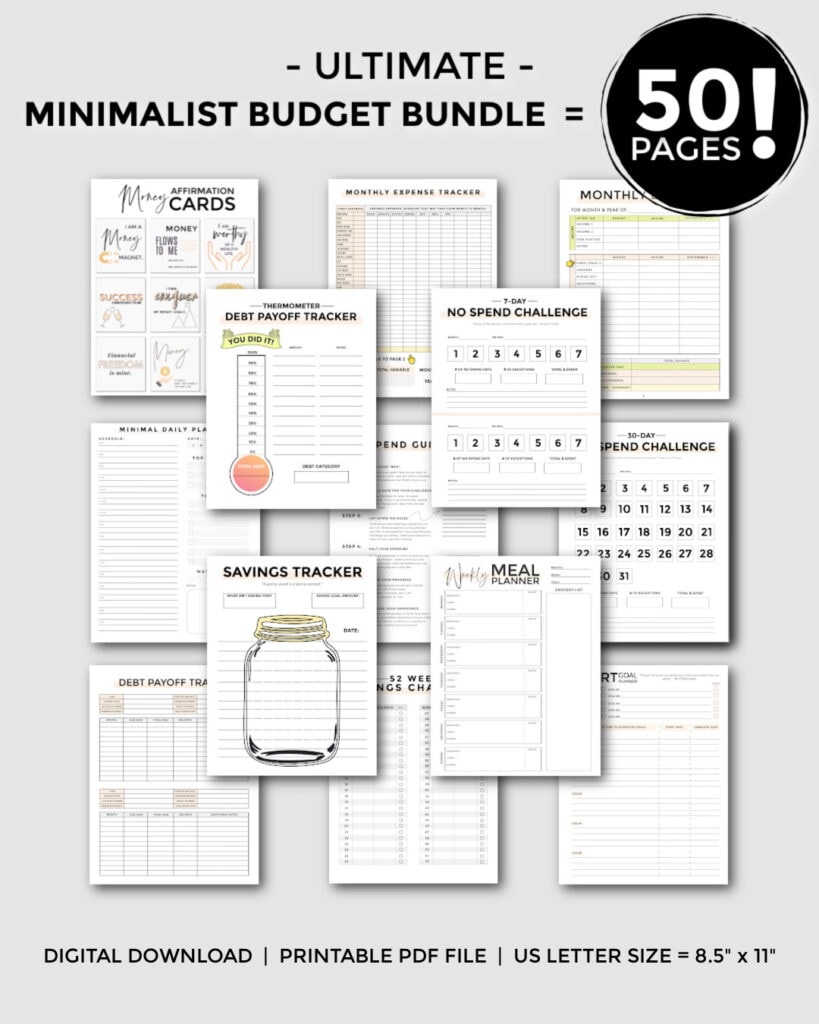

That’s why my minimalist budget bundle has a printable with money affirmations because I know how hard it is to change your mindset around money! You can see the affiliations and all of my budgeting tools by clicking the button down below.

Final thoughts on bad money habits

I hope you enjoyed this blog post about bad and good money habits.

My husband grew up in third-world poverty, and I lost everything in my early 20s, yet here we are – debt-free and living in our dream home in Europe! If we could change our financial stars, I believe you can, too.

What are some of the bad money habits you’ve been trying to break? Were there any habits that I missed?

Feel free to share your thoughts and experiences in the comments section below!

YouTube videos about Bad Money Habits

Pin this post to read again!